Life Insurance in and around Springfield

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Northridge

- Xenia

- Yellow Springs

- Huber Heights

Be There For Your Loved Ones

State Farm understands your desire to protect the people you're closest to after you pass. That's why we offer terrific Life insurance coverage options and considerate caring service to help you opt for a policy that fits your needs.

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Love Well With Life Insurance

When selecting your Life insurance coverage, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like how old you are, how healthy you are, and perhaps even body weight and occupation. With State Farm agent Chris Hunt, you can be sure to get personalized service depending on your unique situation and needs.

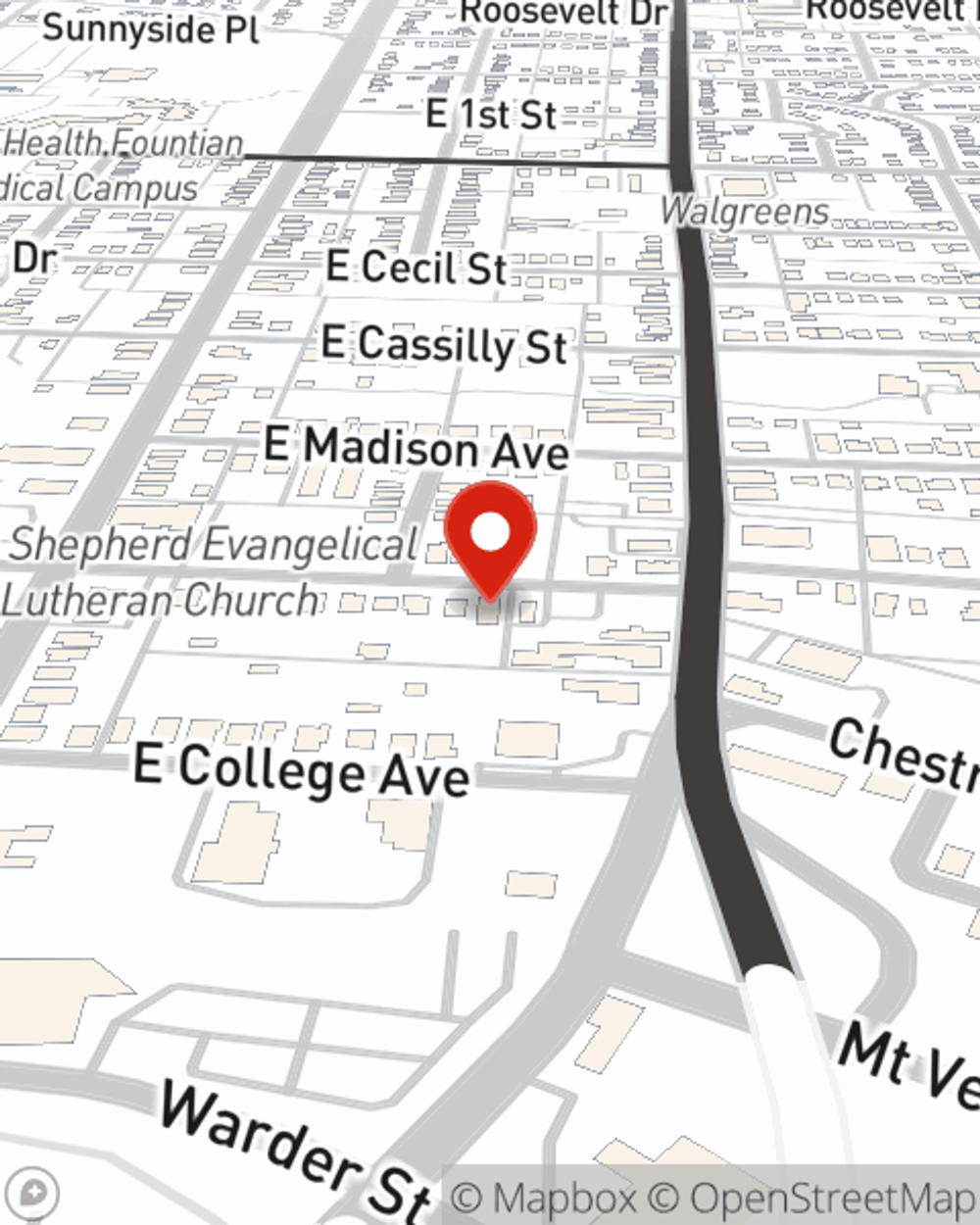

To experience what State Farm can do for you, reach out to Chris Hunt's office today!

Have More Questions About Life Insurance?

Call Chris at (937) 688-5684 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.